First Class Business For Solutions

Mortgage

Subsale

Property financing facility for the secondary market nationwide

Refinancing

Property Refinancing facility to restructure existing rates to lower rates nationwide

Debt consolidation

Restructuring all existing facilities by consolidating it into a singular financing facility through property financing.

P2P Fintech

Bridging SME to Peer to peer investors through digital financing. Request for funds, project financing, factoring for your invoices & PO’s and etc.

Working Capital Financing

Working capital financing, which are short term in nature, are designed to provide funds for the working capital needs of a company

Franchise Financing

A Financing that provides Issuer/Franchisee with term financing to purchase a business franchise from a franchisor

Project Financing

A financing that typically provides the Issuer the funding (financing) of short to long term projects.

Dealer Financing

A financing that provides Issuer / Dealer to finance the purchase of new / used motor vehicles.

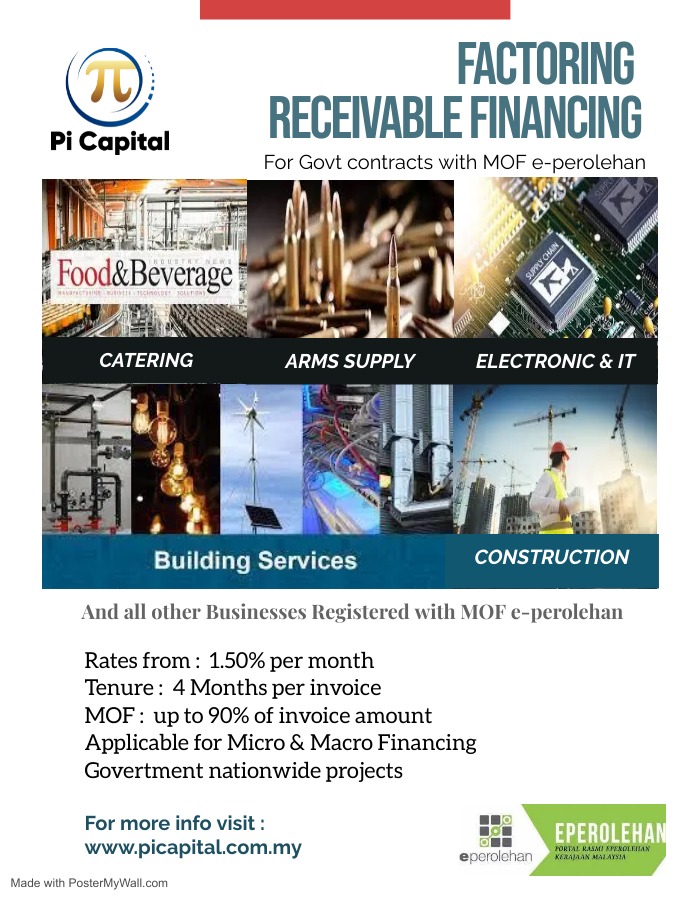

Trade Invoice Financing

A Financing where the Issuer (“Seller”) sell their future receivables or invoices that the seller's issue to their customers (“Buyer”) to get immediate cash.

Personal Loan

Non secured financing facility for individuals either employed or self employed. From short term financing to long term financing

Why Choose Us

Customer Focused

Streamlined processing of digitalized documents, studying, analyzing & consulting each case to match the approval criteria of the panel financiers thereby cutting the entire loan processing Turn Around Time to a minimal.

Business Partnership

At PWV, what makes us stand out as a Financing platform is our strong yet vast network of our panel financiers and partnering financiers who are eager to expand and guide you through the entire loan process.

Success Rates

Our success rates in approvals are one of the highest, as we are constantly in touch with the latest approval criteria of our panel financiers and coupled with extensive financing options, we are proud to say that at PWV, almost all cases will be financed